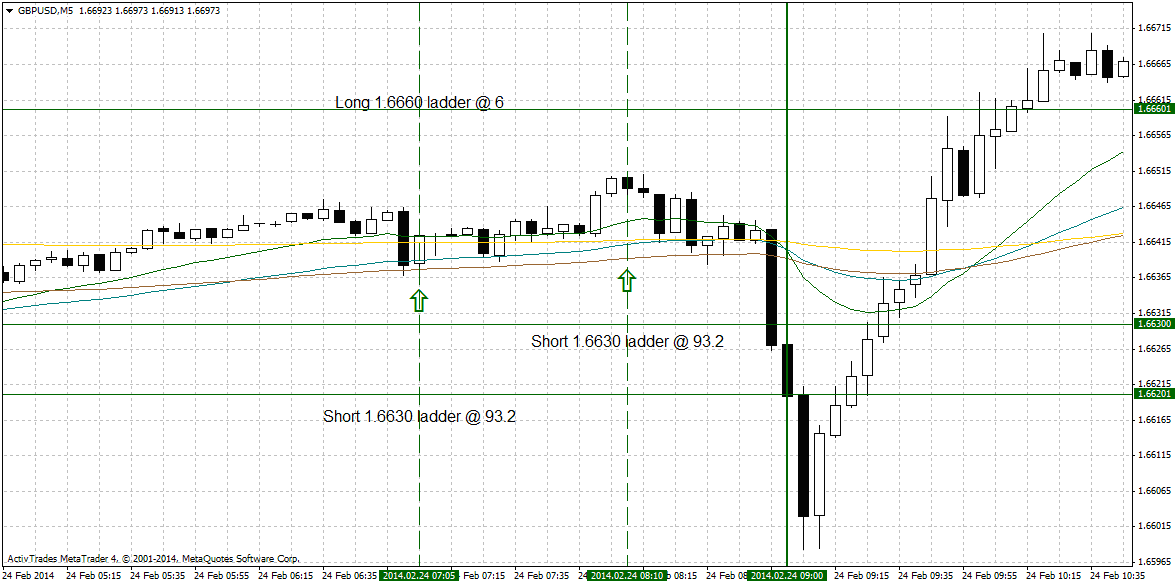

Options offensive strategy example

One of the best advantages that options provide is that you can adjust the position according to the current price action. Actually, traders have huge opportunities to take advantage of the price moves. Let me show you with an example what you can do. Around 6 AM (GMT) you buy a binary strangle (ladders with strikes 1.6620 and 1.6660) for total cost of 12.8 pts. Your max profit is 100-12.8 pts, or 87.2 pts. The price has to move in either direction before 8 AM GMT to make money.

After you buy the strangle, the price goes up 10 pips. The 1.6660 ladder costs now 16 pts. You have the following options:

- to close the 1.6660 ladder and take 3 pts profit.

- to close the 1.6660 ladder (or 1/2 of the position) and sell 1.6630 ladder at 94 (6 pts risk)

- to keep to ladders and sell 1.6630 ladder at 94 (6 pts risk).

Keeping in mind that before London open the market usually stays in range, I usually choose the second option. This time you can see that it paid off. GBP/USD tumbled in the last minutes before the expiry and the profit for the 1.6630 ladder was 94 pts.