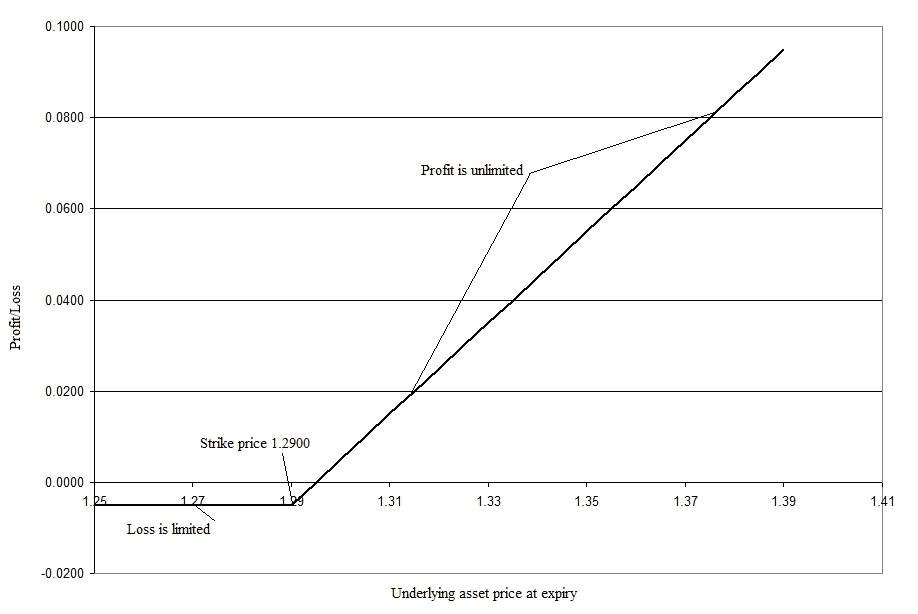

Long call option

The buyer of a call option has the right, but not the obligation to buy the underlying asset at a specified price (strike price) at or before a specified date (expiry of the option). The risk of the buyer of the call option is limited to the amount of the premium paid, plus transaction costs. The potential for profit is unlimited after the price of the underlying asset rises above the strike price. The value of the call option rises when the price of the underlying asset and the market volatility are rising.

The long call option strategy is most suitable in the following cases:

- When you consider that the price of the underlying asset will rise significantly;

- When you want to have a position with absolute control of the risk;

- When market volatility is low or is expect to rise.

P&L at expiry