The Forex Market Orders

There is an interesting study by a team of the Bank for International Settlements (BIS) from March 2013 the title of which is “Information Flows in Dark Markets: Dissecting Customer Currency Trades” (BIS Working Papers No 405, Lukas Menkho, Lucio Sarnoz, Maik Schmeling, Andreas Schrimp). The authors found that “the flow of orders contains a lot of information about the future movements in exchange rates and provide significant economic value to a few large dealers who have access to the information about them. Furthermore, different groups of customers systematically transfer the risk to each other and differ significantly in their ability to predict [the movement of currency pairs], style of trading and risk exposure.”

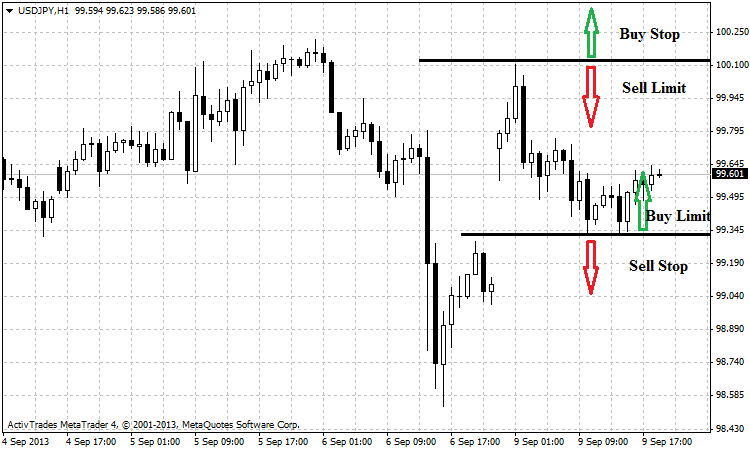

It is a very important to know very well the different types of orders. Basically, there are two main types - market and pending. Market orders are executed immediately at the best price currently available. Pending orders are activated when a certain condition is met, most often it is to reach a certain price level. The most popular pending orders are the stop and the limit orders. Stop orders become market orders, when price reaches a certain level, and then are executed as such, i.e. at the best available quote. Limit orders also activated at a predefined price. The difference with stop orders is that the price of execution should not be worse than price of the order. With a limit order to buy the execution price must be equal to or higher than that of the order.

The characteristics of the two types of pending orders determine when they should be used. Break outs are usually traded with stop orders while the retracements with limit orders. We can use the pending orders as follows:

- long position from a level below the current market price - Buy Limit Order;

- long position from a level above the current market price - Buy Stop Order;

- short position from a level below the current market price - Sell Stop Order;

- short position from a level above the current market price - Limit Sell Order.

Types of orders in the forex market