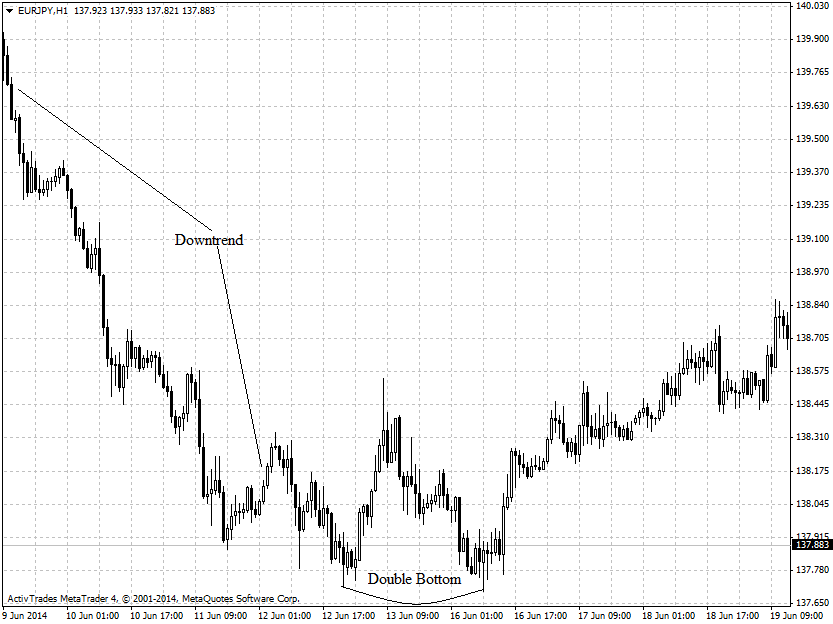

Chart patterns - Double Bottom

The Double Bottom pattern is an mirror image of the Double Top. In this case the original trend is down. The prices reach a new low and then follows a corrective rally. The market is taking a breath, and bears gather forces to reach new low and resume the trend. Then a new leg in the direction of the trend starts and the pair reaches a new low, which usually is equal to the previous one. Sometimes the two bottoms do not match perfectly, but a small difference is normal. After the second low is reached, the new uptrend starts instantly. Classical entry is above the swing high reached during the corrective rally, but I recommend buying around the second low with small stop or on a second break.