Commitment of Traders report (COT)

The forex market is decentralized and we can't obtain reliable information about the positions of the traders. How can we find out what the large market participants intend to do? Very practical way to do this is to analyze the the Commitments of Traders (COT) report. It was first published by the U.S. Commodity Futures Trading Commission (CFTC) in 1962, and covered 13 agricultural contracts. Its purpose was to provide information about the current situation of the futures markets. At the beginning, the data were presented once a month, but since 2000 the information is published weekly (at 3:30 p.m. Eastern time every Friday with data collected on the last Tuesday) on the Commission's website (http://www.cftc.gov/MarketReports/CommitmentsofTraders/index.htm). Moreover, the scope of the report was expanded, and now it includes data on market positions in currency futures also. To understand the Commitments of Traders report you need to know the following concepts and terms:

- Commercials - All traders who are engaged in the production, processing and sales of the product, and use futures to manage some risk. These traders are also called hedgers;

- Non-commercials - Large financial institutions or traders, funds that use futures for speculative purposes. These traders are also called large speculators;

- Non-reportable positions - Traders with positions that are below the minimum required by the Commodity Futures Trading Commission's limits for position reporting;

- Reportable Positions – All the positions at or above the Commodity Futures Trading Commission’s reporting level in any single futures month or option expiration;

- Open interest - The total number of the option or futures contracts that are currently not closed by offset operation, delivery or exercise;

- Short report - Shows open interest separately for reportable and non-reportable positions;

- Long Report - In addition to information from the short report, contains data on the concentration of the positions of the largest traders.

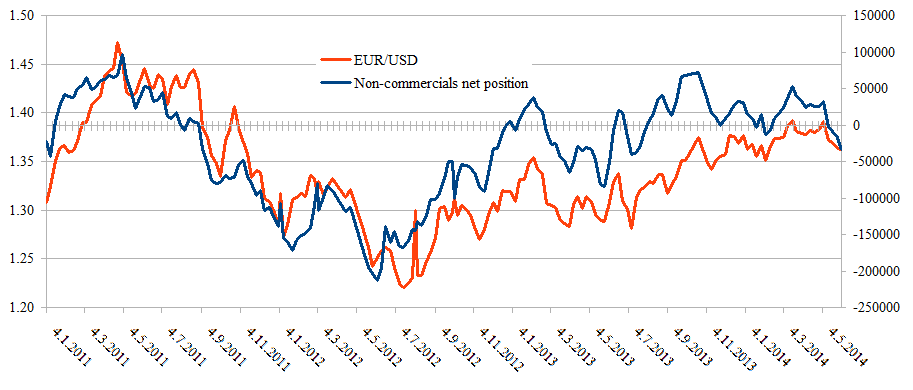

On the chart below, you can see the correlation between EUR/USD and the net position of Non-commercials.