Condor

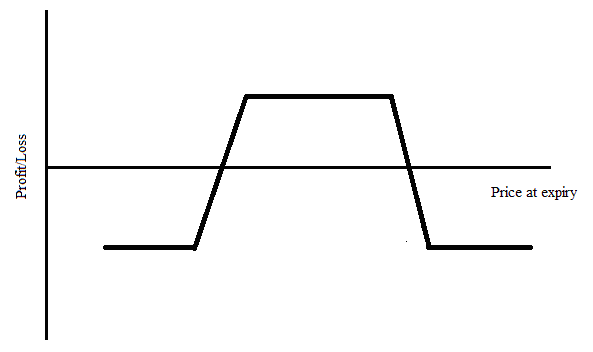

Condor is an option strategy that can be applied for trading of the volatility of the underlying asset. This strategy could be implemented with four options with different strikes but the same expiry. If we want to make money when the market is in a range, we can structure long condor, by selling in the money call with lower strike, buying another in the money call with an even lower strike, selling out of the money call with higher strike and buying another out of the money call with even higher strike. Condor can be structured by put options as well. This is a debit strategy and the loss is limited to the net premium paid. The maximum profit is also limited and occurs when at the expiry of the underlying asset price is between the two middle strikes.

P&L at expiry

Mirror strategy is called short condor and should be applied when we expect an increase in volatility. It is structured by buying in the money call with lower strike, selling in the money call with even lower strike, buying out of the money call with higher strike and selling another out of the money call with even higher strike. There is a variation of this strategy, which is more popular and is called iron condor. To structure this strategy we sell put and call options that are out of money and buy another put and call option more distant strikes.