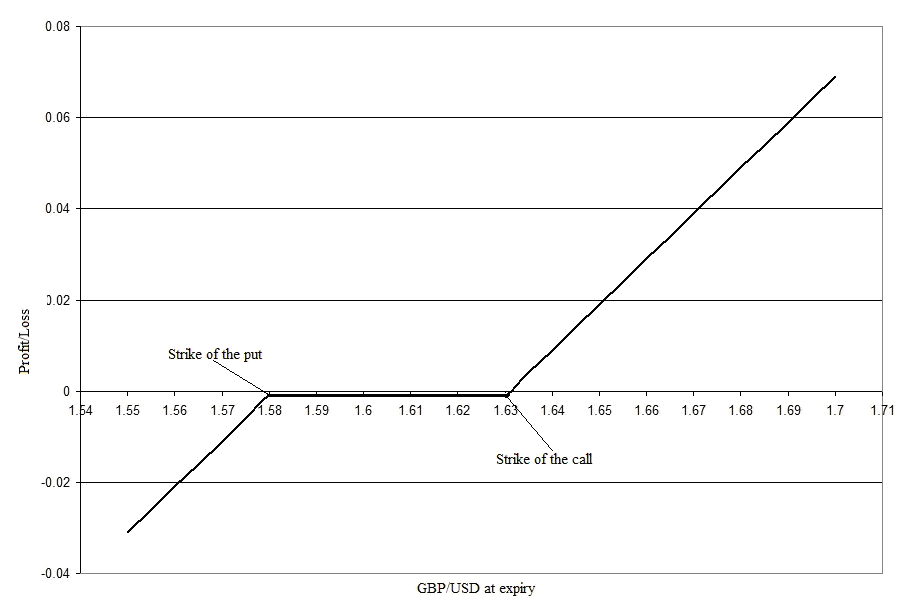

Collar (Risk Reversal)

This option structure is established by the simultaneous purchase of a put or a call option and sale of the other type option with the same expiries. If you buy an OTM call and sell an OTM put, you will have the so called risk reversal, which is a type of collar. If the premiums of both options are equal, this is a zero cost collar (ZCC). ZCC is also known as synthetic or range forward and is often used for hedging.

P&L at the expiry