Forex Trading in Low Volatility

You have probably noticed that the volatility of the most popular FX pairs is very low for weeks. For example, the 20-period ATR for EUR/USD is 55 pips, while for GBP/USD it is 62 pips. More experienced traders remember that this numbers were usually well above 100 a few years ago. When the volatility is low, the price moves are shorter and slower and it is much more difficult to make money. Fortunately, today the FX brokers are presenting much more opportunities to their clients.

Binary options are very good for trading in low volatility environment. Traders can use the leverage and trade with good risk/reward ratio even when the price moves are of just a few pips. This is providing the traders with an edge, but of course there is a catch. The trick is that you must find the right option (with the appropriate strike and time to expiry) when there is a tradable set up. This requires a lot of experience and screen time, but is justified.

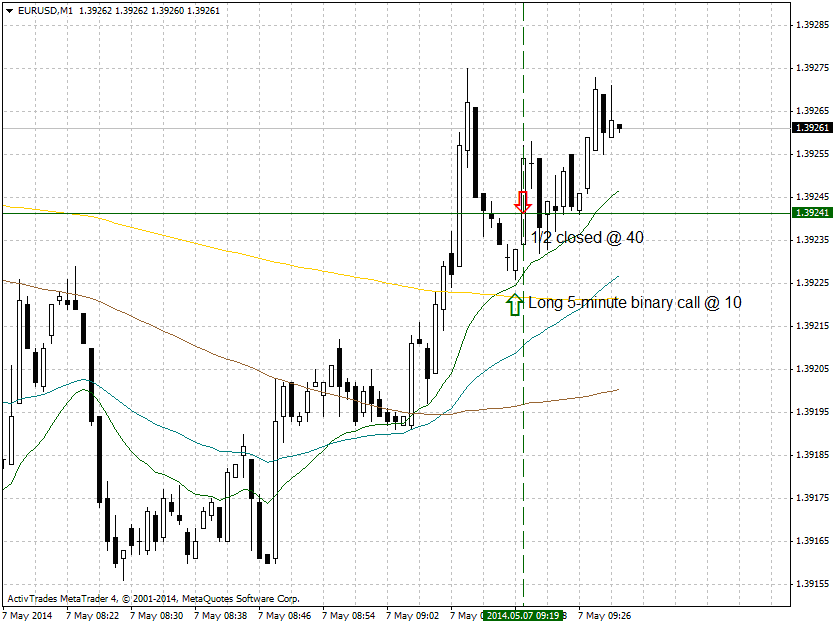

In the examples below you can see to trades of the last week. The set ups are the good ol' STE (read more here http://www.amazon.com/Price-Action-Strategy-System-Simple-Trick-Entry-Money-Making-ebook/dp/B00GY71CDC/ref=sr_1_4?s=books&ie=UTF8&qid=1399788746&sr=1-4). In this case, the option position is closed in two parts. The profit from the first one covers the risk and guarantees some profit. The second is held until the expiry. You can see that 1-2 pips price move is good enough to trade with 1/6 risk/reward ratio.