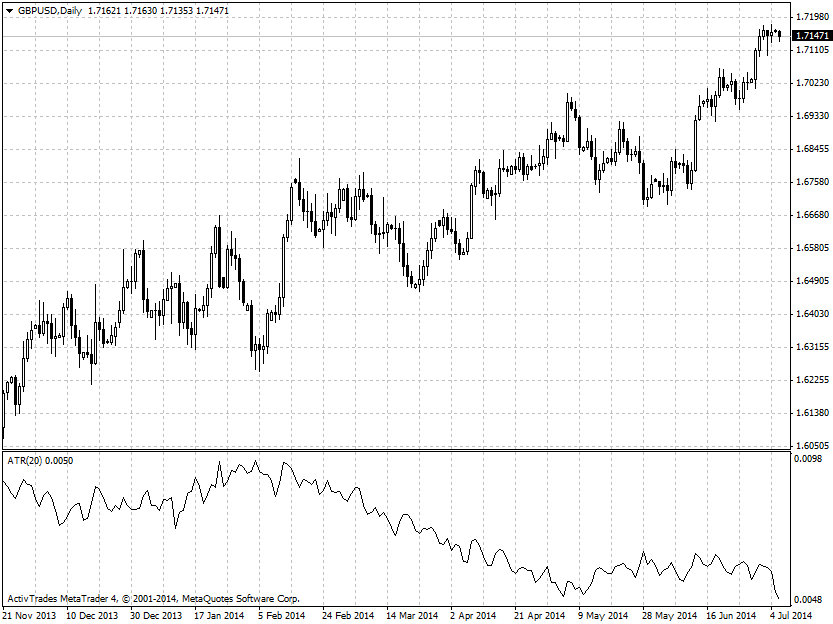

Average True Range (ATR)

Average True Range (ATR) is an indicator that measures volatility and it was designed by J. Welles Wilder. This indicator was developed for the commodities market because they often open with a gap in prices. If we use the regular hi-low range, we will not take into account these gap openings. Wilder created Average True Range to capture exactly this “missing” volatility.

To plot the ATR, we must calculate first the True range, which is defined by Wilder as the greatest of:

- Current High minus Current Low

- Current High minus Previous Close (absolute value)

- Current Low minus Previous Close (absolute value)

When we calculate the true rages of the time periods, we can proceed with averaging to end up with the values for the ATR series. Typical averaging period is 14, but you can use other values as well, depending on the goals for your analysis and the current market conditions.

I think that ATR is an understated indicator which provides valuable information for the traders. This indicator shows the volatility within one time frame and can help you to select which underlying assets to trader. If the ATR is 40 pips, and your initial stop is let's say 10 pips, this currency pair will not be suitable for you. It is a good habit to analyze the ATRs of the most liquid currency pairs and to trade only the ones with decent volatility.