Table of Contents

Trading Methods

Generally speaking there are several main ways of trading - Intuition, Fundamental Analysts, Scalping on News and Events, Technical Analysis.

Trading by intuition

You watch the market price and try to guess what is the most probable direction of movement – Up or Down. When you are confident enough of the direction you open a Long or a Short position correspondingly. Later, you use also your intuition to close the position. This is a very funny and obsessive practice, but unfortunately it takes long time to master and gain experience.

You can practice trading by intuition to develop a sense of the market.

It is a good exercise to watch a Tick chart and to try guessing where the market will go in the next minute. Eventually you will start filling how the market moves, is it calm or rapid, and if it trends in one of the directions.

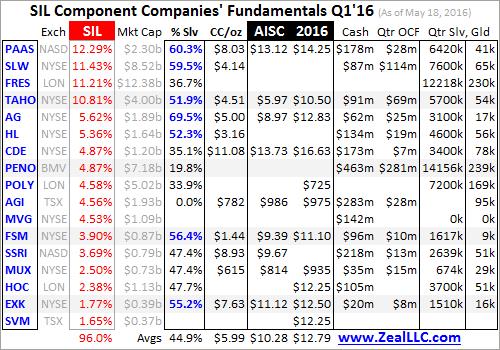

Fundamental analysis

With this method you use the economical or financial indexes to measure the asset value and if you decide that the value is underestimated you buy and sell in the opposite case. This is one of the main trading methods. It is mainly applicable on the stock markets when you have detailed info for a particular company or asset.

Trading on news and events

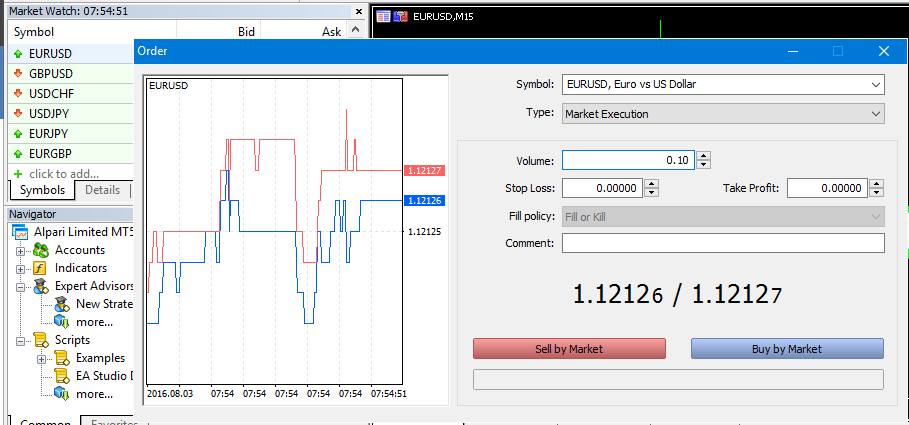

Planned or unexpected news or events can cause some considerable market movements, especially when the news contradicts to the traders’ expectations. You can make fast deals on such conditions, but you have to consider dangers as sharp market reversals, wider spreads and slippages. Such fast trading with near targets is called Scalping. You may prefer Binary Options here because the risk is better defined.

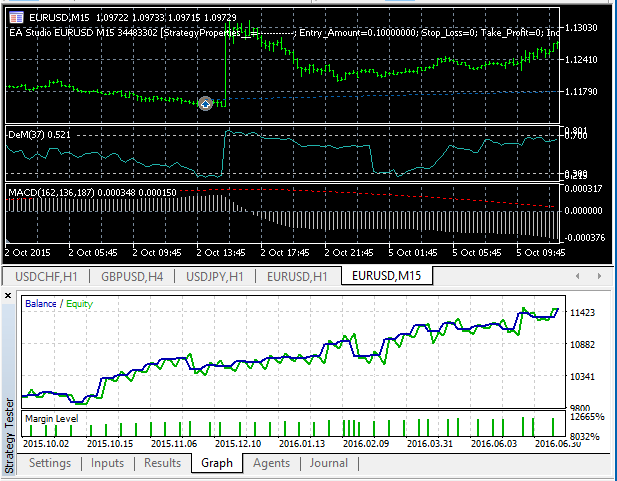

Technical analysis

You use technical indicators to evaluate the market price and trade on signals as indicators reversals, cross-overs, price patterns, etc. You can combine several indicators in a trading strategies and perform tests on history data for analysis and automation of the trading process. We think this is the most scientific and successful way of trading. We will cover all details about the Technical Analysis in the following articles.

~~DISQUS~~