Table of Contents

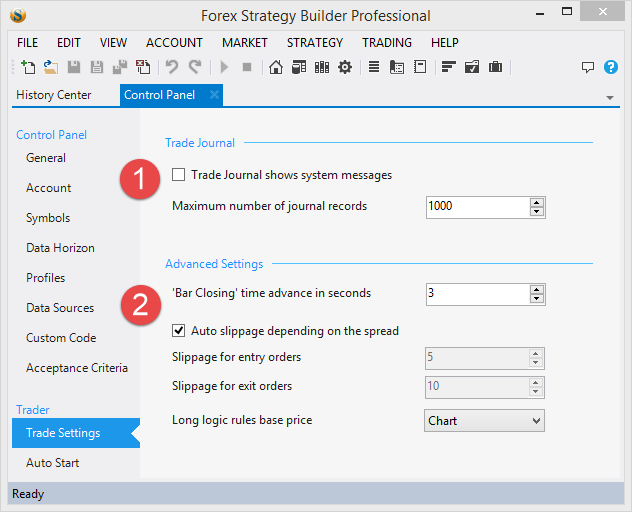

Trade Settings

1. Trade Journal

Trade Journal shows system messages - enable this to get more insights on the workings of FSB Pro while trading

Maximum number of journal records - keep the given amount of records in the Journal window. You can access the full log files by going to File → User Files Folder… and open the Logs folder

2. Advance Settings

We highly advise that you consult with the forums and your common sense before starting to change the options below. Changing these options may result in severe dysfunction of the main program features.

'Bar Closing' time advance in seconds – in theory the bar should close when its time is up. For example on a D1 chart, the bar should close at midnight. This means at 23h 59m 59s and 999 thousandths of the second. In reality, however MT4 works with tick data and there is not a “signal” where the bar closes. In the historical data, the bar ends with the last tick, the last change of the price. When you are trading, FSB Pro cannot know if this tick, that it just received, will be the last tick in this bar.

If your strategy requires a “Bar Closing” event, it cannot trade at the very moment of the closing of the bar. It does the trade will take place in the next bar due to connection and server delays. Therefore, it has to trade before the bar has closed. In the default setting – three seconds before the closing of the bar. This will allow for the sending of the order and its execution within the time frame of the bar. We have tested this setting through the years and is working well for most traders with good hardware and internet connection.

Auto slippage depending on the spread – if checked FSB Pro will automatically set the slippage, depending on the volatility of the market. The bigger the spread, the bigger the slippage will be. It is safe to keep this option on. You can always override it by removing the check mark. If you do that, you will be able to set concrete values for slippage for entry and exit orders. It is a good practice to keep the entry order slippage less than the exit order one.

- Slippage for entry orders

- Slippage fore exit orders – if you are setting a value manually, it is advisable to keep this number high. This will help to not close a position too early and lose money.

- Long logic rules base price – This option exists to let you choose based on which price the technical indicators will be calculated. By default, the option is set to Chart. The chart you see while trading usually consists of Bid price data. However, this is not always the case. This happens because the broker might show you some price on the chart price but adds a commission to it. There have been such cases with some of our users in the past.

This option is set to price “Chart”. This works well for brokers that draw the price chart based on Bid price, as well as for brokers that have some other type of price calculation.

If we speak purely theoretically, one should calculate the Long positions based on Ask price.

We advise to keep this option to Chart if you do not have any particular reason to change it.