Table of Contents

Entry Rules

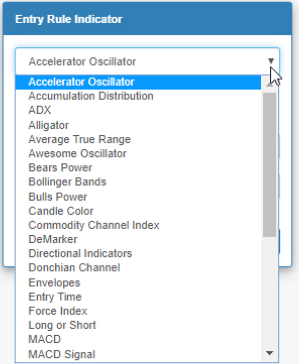

EA Studio provides you with various indicators that you can use for your entry rules. You also have the option to adjust their parameters and logic rules. This way you can get the best Forex Entry Point.

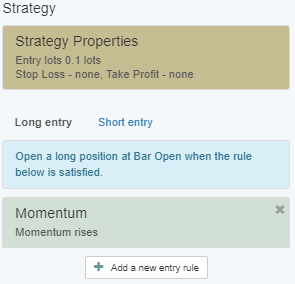

As soon as a new bar opens on the chart, each of the entry rule is evaluated. The strategy needs to determine whether it should open a position in a certain direction. For example the evaluation of an Entry Rule might give a result that is “short: false; long: true;”. This means according to this rule the strategy should enter a long position.

A practical example of such entry rule is if you use a Momentum indicator with a logical rule “Momentum rises” that means that when the Momentum value becomes higher than the previous one the indicator will allow the opening of a long position.

However EA Studio only opens a position when all Entry Rules' requirements are met. So this means if we have two Entry Rules in the strategy and one signal, the opening a long position and at the same time another signals to open a short one EA Studio will not act and will not open a position.

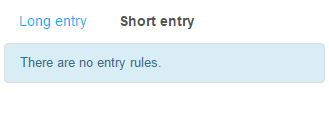

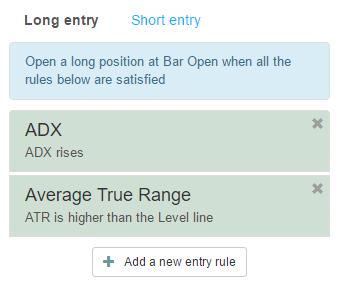

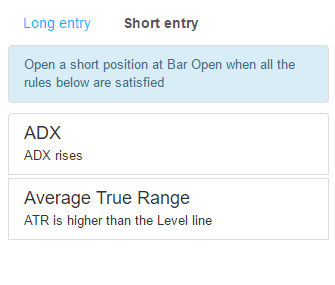

You have to set only the rules for the long positions. EA Studio will set the rules to enter a short position automatically. It will do so by mirroring the long rules. You can see the short entry rules by clicking the Short entry tab above the Entry Rule list.

Examples

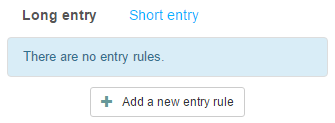

No entry indicators

In this case EA Studio will not open a position because there are no rules to determine the direction of the entry.

Add/Remove Entry Rules

You can add Entry Rules by using the + Add a new entry rule button. The maximum number of Entry Rules you can select is 4. The button + Add a new entry rule button will become inactive when this limit is reached. When you click the button, the program will open an Entry Rule Indicator panel at the left side of the Editor. You can choose an indicator there and set its Logic and parameters.

To remove an Entry Rule just click the X button on in the top-right corner of its box.

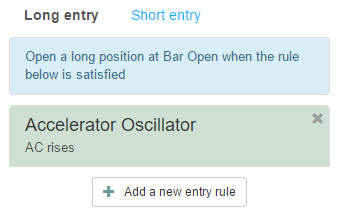

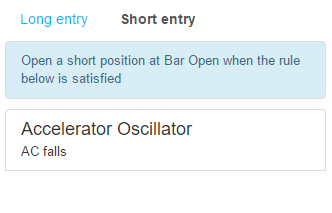

Using a Single Entry Rule

All of the indicators express a logical condition that can either be fulfilled or not fulfilled. When creating a strategy, you should set the Long trading rules and the program will assume the reverse rules for the Short trades. In this sense the strategy uses symmetrical conditions for long and short positions. The general rule of thumb is that the condition is fulfilled for a short position but not for a long one or vice versa. In some cases, the condition can be fulfilled in both directions of trade at the same time (when using ADX for example).

The strategy will trade Long when “AC rises” and will trade Short when “AC falls”. You can confirm that on the Indicator chart at the Report page.

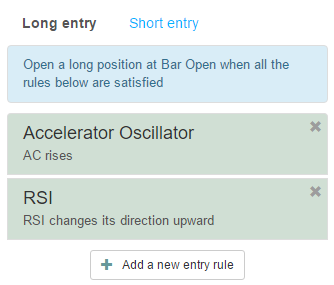

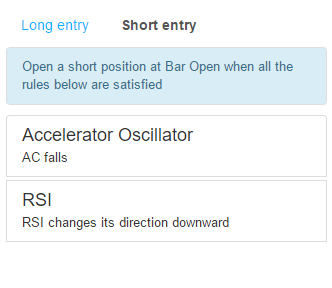

Using multiple Entry Rules

When a strategy has more than one indicator, it will trade only if all indicators give permission for entry in the particular direction.

In that example we have two indicators. Following the strategy logic, the program will:

- trade Long - when: “AC rises” and “RSI changes its direction upward”. If one of the rules' requirements is not met, the strategy will not trade.

- trade Short - when: “AC falls” and “RSI changes its direction downwards”. If one of the rules' requirements is not met, the strategy will not trade.

Ambiguous rules

There are cases when the Entry Rules' indicators might produce equal signals to trade in both directions at the same bar.

Example:

The strategy above will not trade because its rules give permissions for both Long and Short entries. If you recreate this strategy in EA Studio and switch to Short rules, you will see that they will be equal to the Long rules. Because the conditions are ambiguous, the strategy acts safely and prevents all entries.