Table of Contents

Indicator Properties

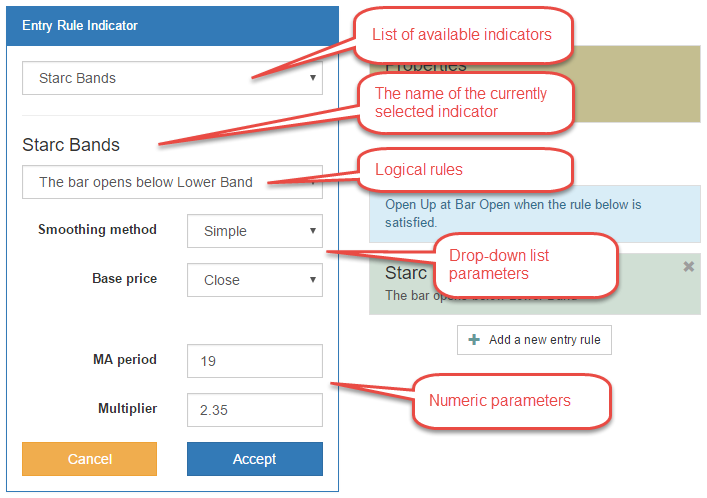

The Indicator Properties panel contains controls for selecting indicator, logical rules, and indicator parameters.

You open the Indicator Properties panel by clicking on the “Add a new entry rule” button or, if there are already indicators, by clicking on an indicator tile.

When the Indicator Properties panel is open you cannot work with the other options of the strategy. You have to close the panel first.

Components

The Indicator Properties panel consists of several vertically arranged zones:

Indicators list

This drop-down menu contains the names of all available indicators. When you select one indicator, the program loads its default parameters.

There is a trick you can use if you want to reset the parameters shown below - select another indicator and return back to the previous one. When you do it, the program will replace the current settings with the default ones.

Indicator name

You see the name of the currently selected indicator.

Logical rules

Every indicator has a predefined set of logical rules. The rules are carefully designed in a way that can be always evaluated to “true” or “false” for both - Up and Down trade.

It is important to remember that you always set trading rules for an Up position. The program automatically composes mirrored rules for a Down position. See more explanations and examples in the Up rules and Down rules sections of the help.

List parameters

Most of the indicators has parameters arranged in drop-down lists. Some of the important parameters are:

Smoothing method - this parameter determines what type of Moving Average smoothing is used for calculation of the indicator. The available options are: “Simple”, “Weighted”, “Exponential”, “Smoothed”.

Apply to - the base price determines what price is used for the calculations. The common options are: “Open”, “High”, “Low”, “Close”, “Median”, “Typical”, “Weighted”. Some indicator uses “Bar range” or another value. We strongly recommend to leave the default value of this parameter.

Numeric parameters

Some of the most common numeric parameters are listed below.

Period - many of indicators has a period. It is measured in bars. You can set maximum 200 bars.

Level - the level parameters is used commonly from indicators like oscillators or histograms. The Level parameter is considered in the calculations only if it is included in the logical rule. For example, “RSI crosses the Level line upwards”. Some indicators use one Level one, but other two lines. You set only the Level, that corresponds to an Up trade. For example, if you set Level = 20 for RSI, the app will consider Level = 80 for Down entries.

Control buttons

- Cancel button cancels all changes you have made and leaves the strategy unchanged.

- Accept button applies your settings to the expert. BO Tester recalculates the strategy immediately and shows the corresponding stats and charts.

~~DISQUS~~