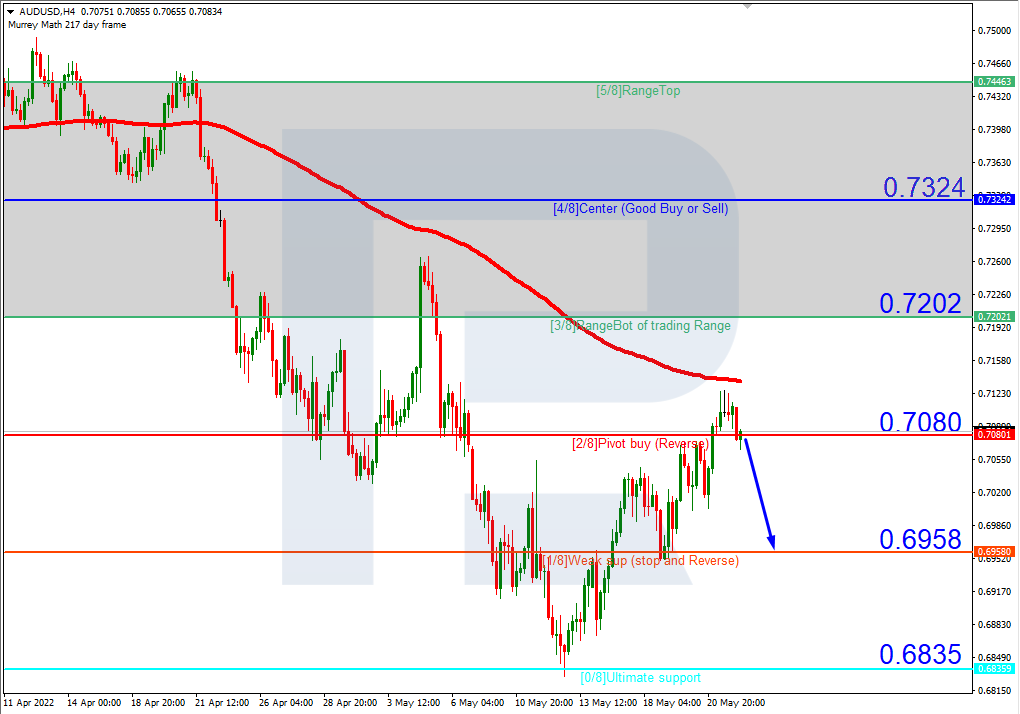

The Aussie is retreating. Overview for 01.06.2022

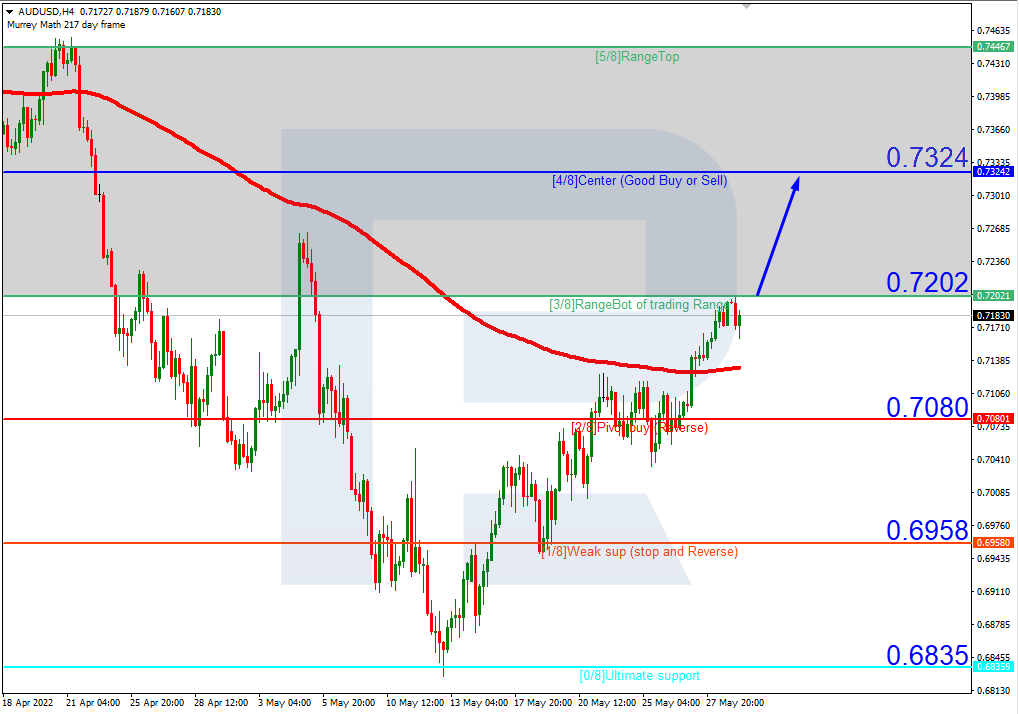

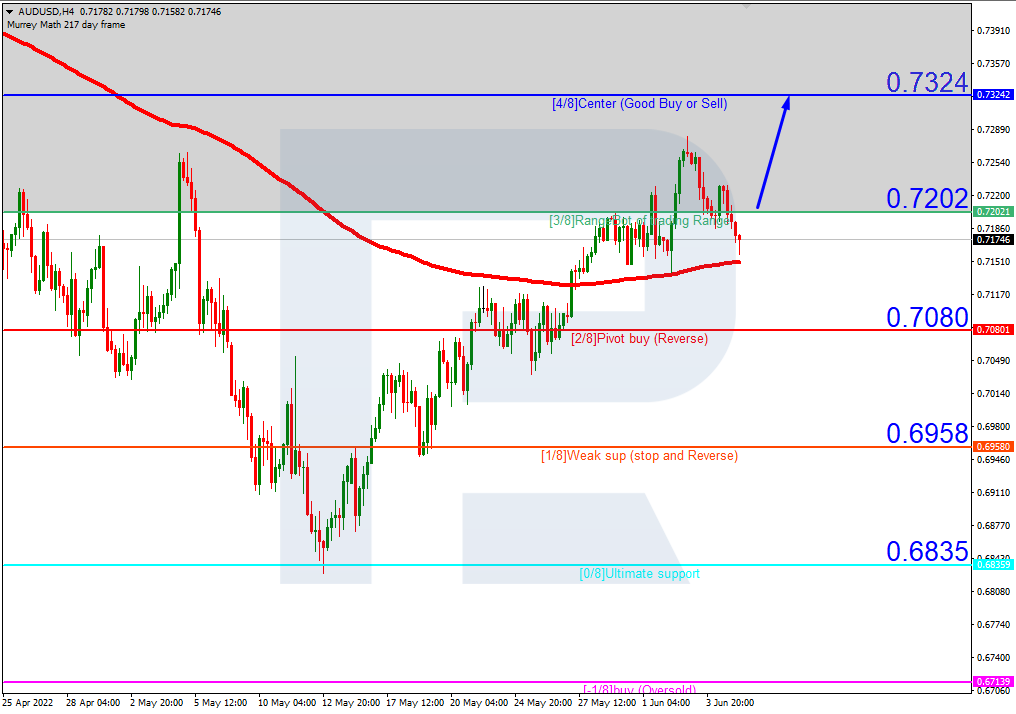

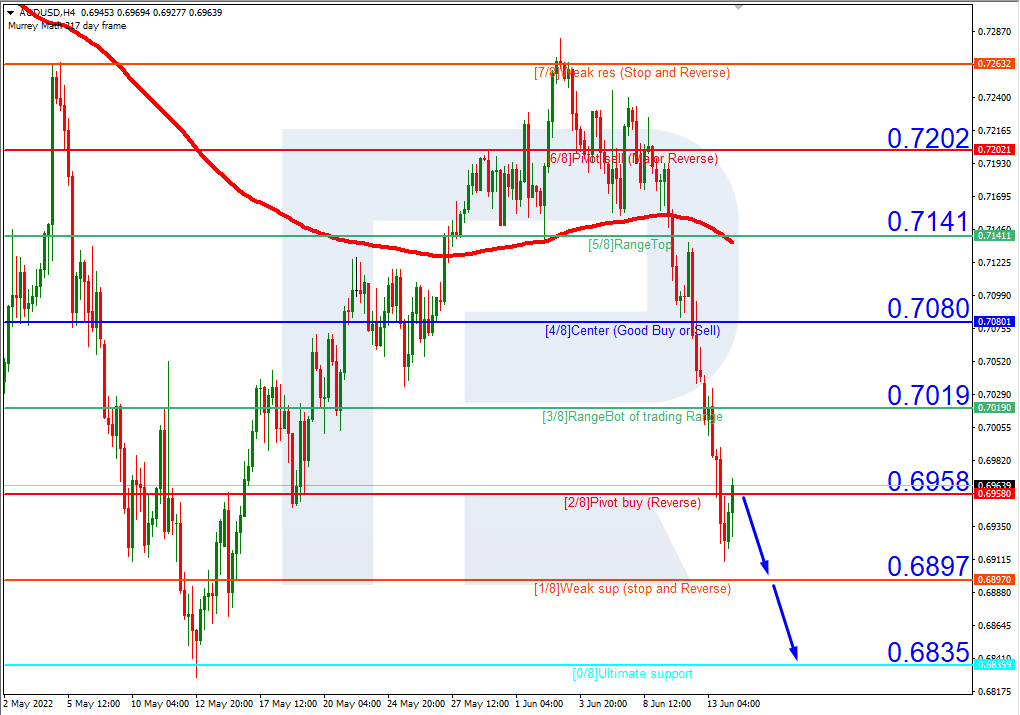

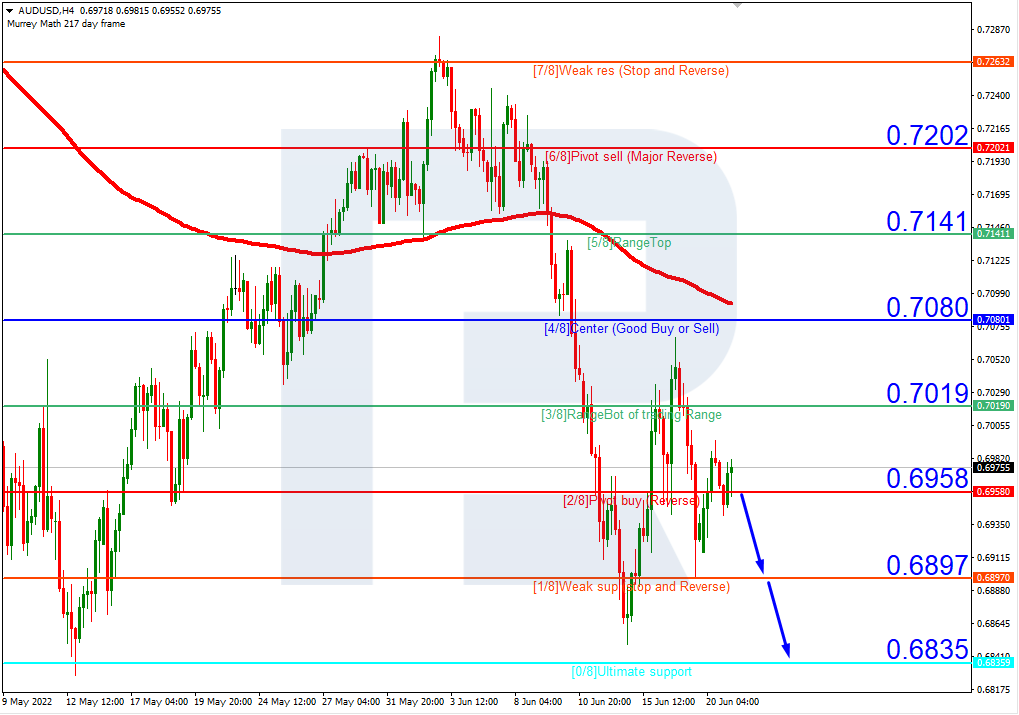

After growing earlier, AUDUSD is now correcting.

The Australian Dollar is falling a bit against the USD on Wednesday. The current quote for the instrument is 0.7180.

The Aussie had a great run and now requires a correction. On the other hand, the “greenback” is increasing the pressure – investors need “safe haven” assets as the external background is getting worse.

Today’s statistics showed that the Australian GDP added 0.8% q/q in the first quarter of 2022 after gaining 3.6% q/q the quarter before and against the expected reading of 0.6% q/q. On YoY, the indicator showed +3.3% against market expectations of +3.0%

The labour market in Australia is stable, which means that consumer incomes are stable as well. The question is about spending: how strong should inflation be to make people revise their spending and even cut it? One more negative factor is Chinese lockdowns – China remains Australia’s key trade and economic partner.

High oil and energy prices affect inflation and, hence, the GDP dynamics as well. Nevertheless, one should admit that Australia is doing a good job in handling the CPI so far.

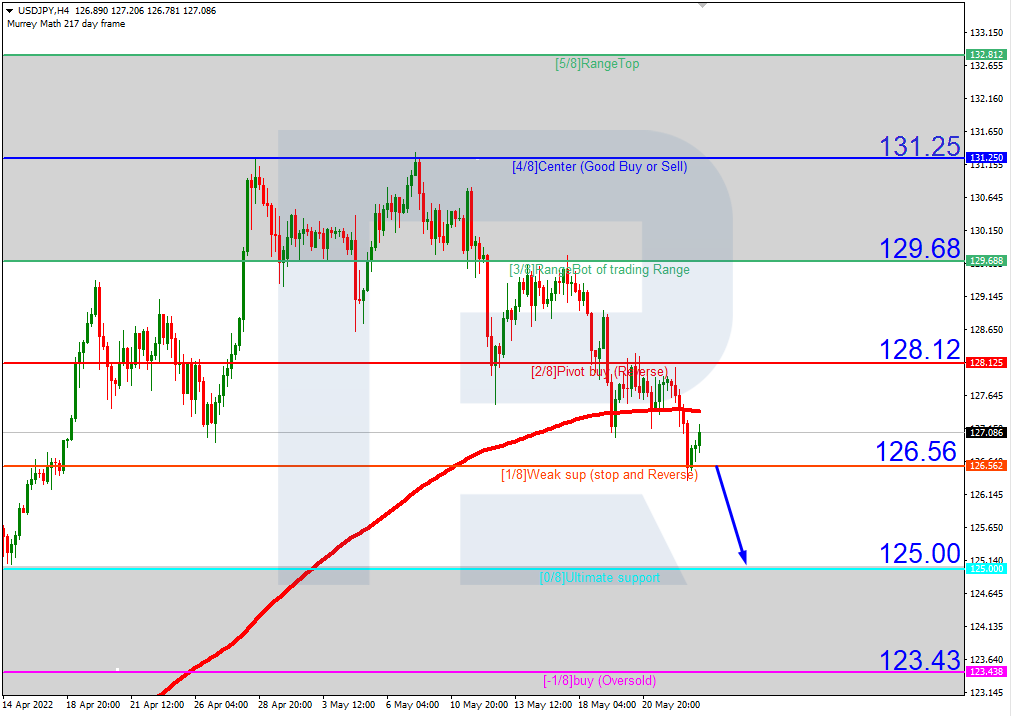

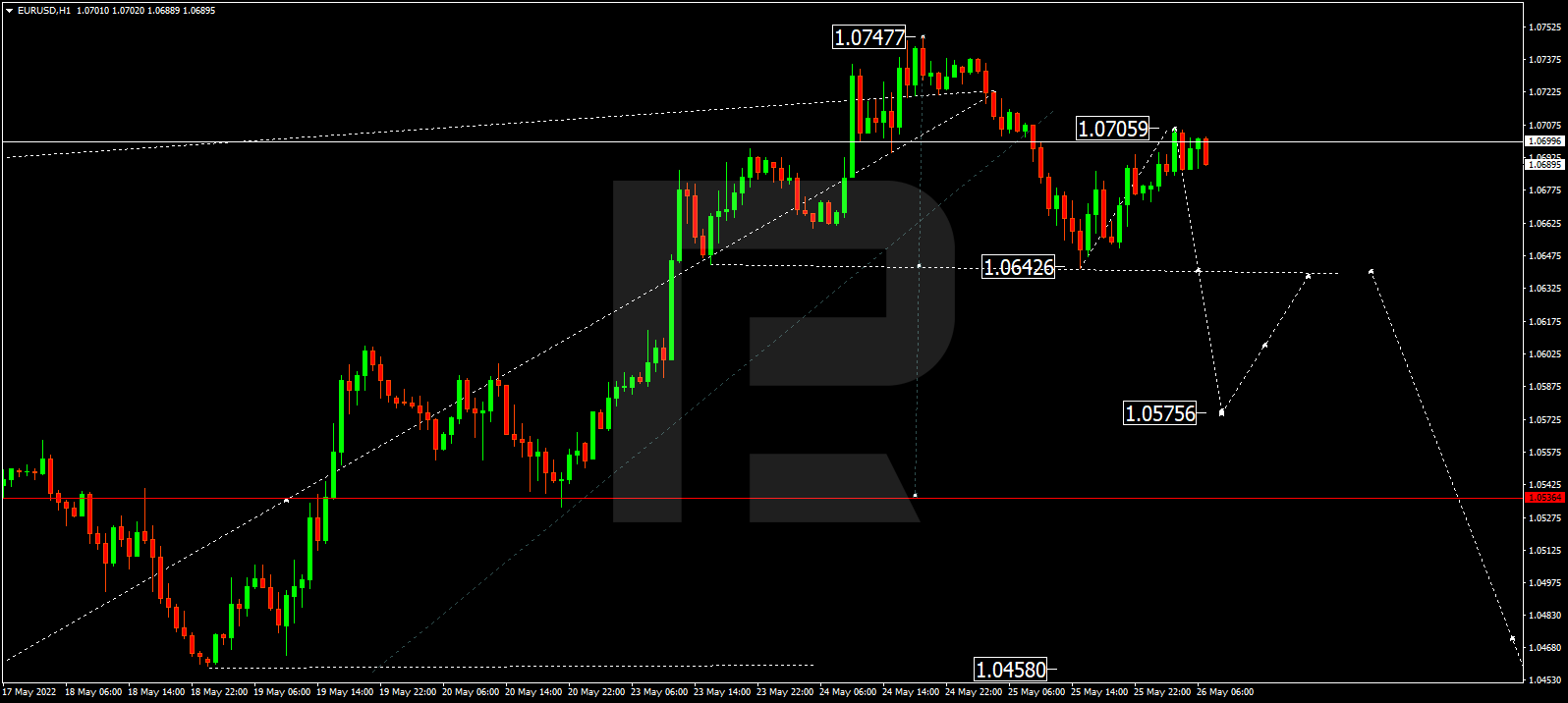

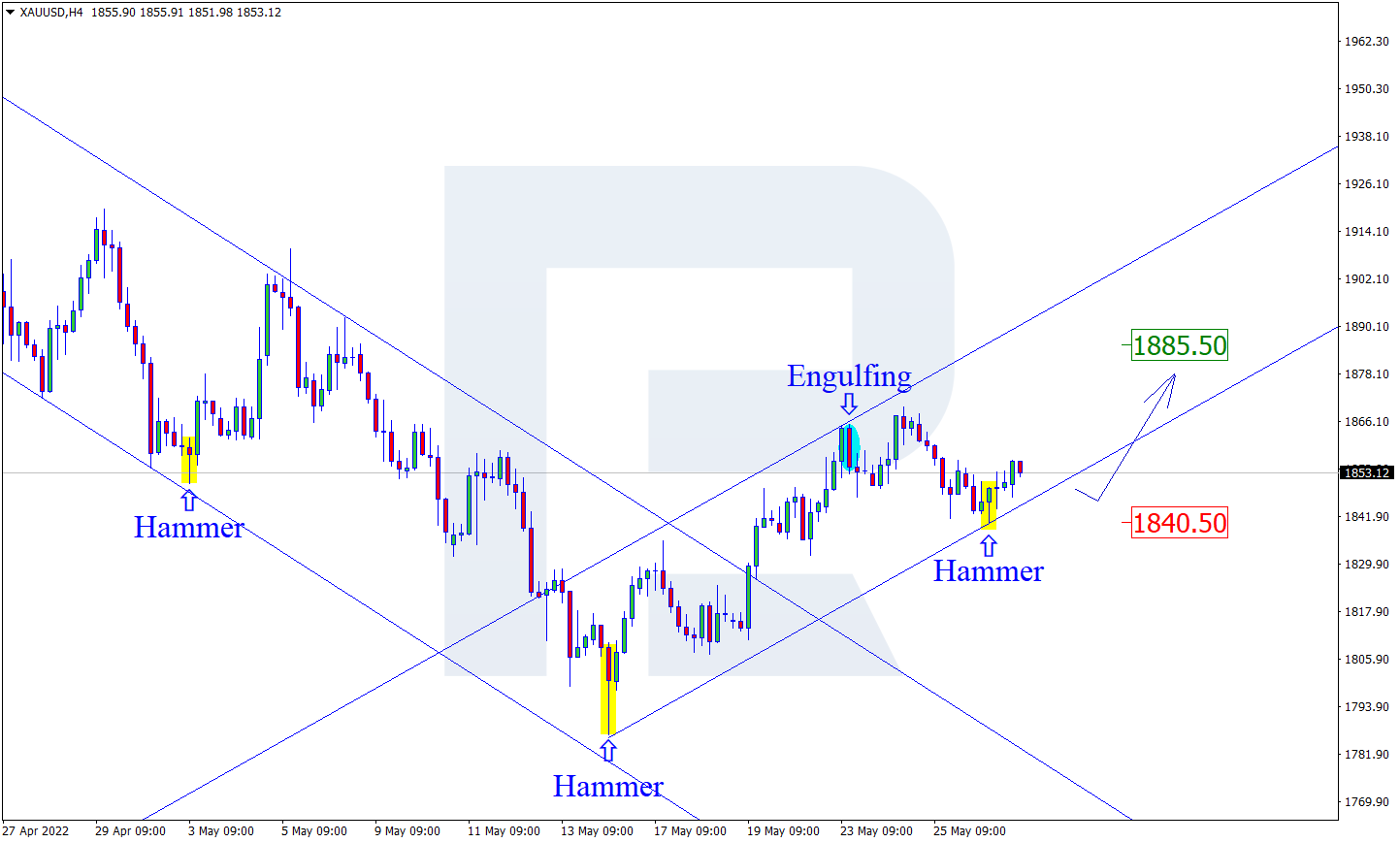

Forecasts for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.