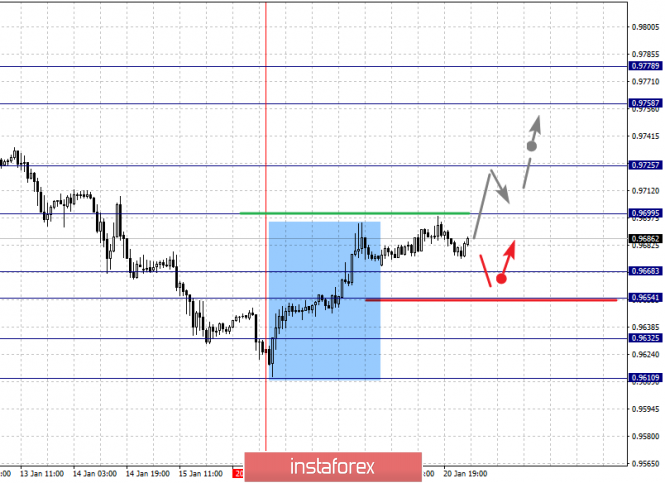

Fractal analysis for major currency pairs on January 21

Forecast for January 21:

Analytical review of currency pairs on the scale of H1:

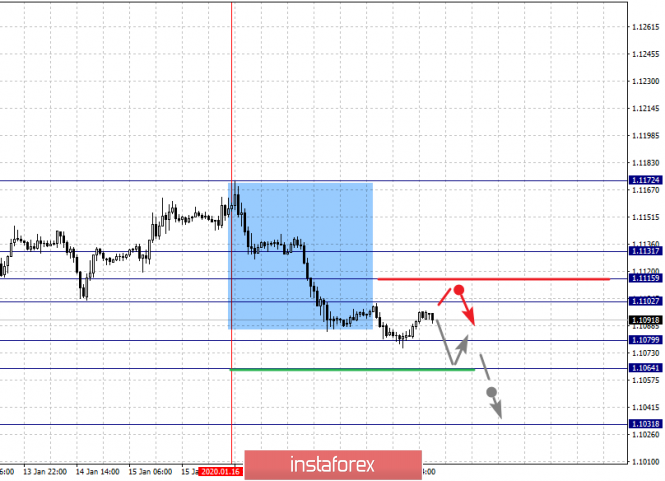

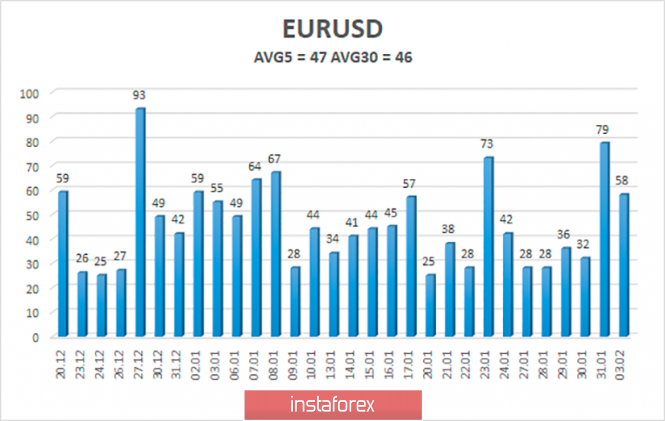

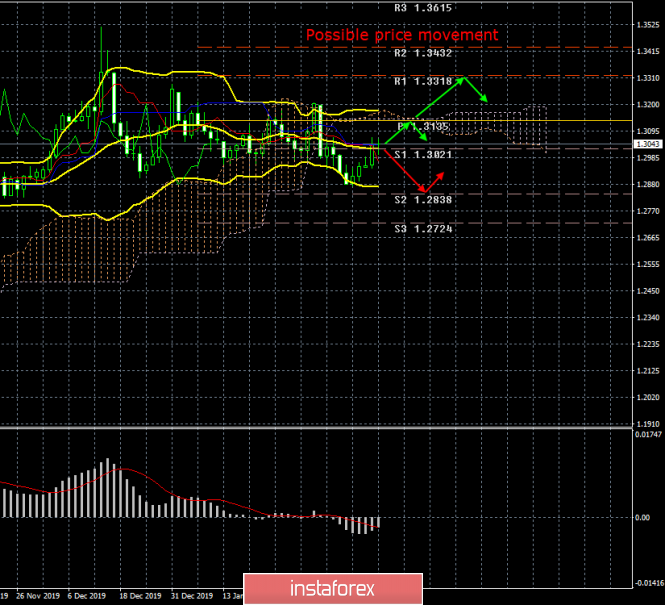

For the euro / dollar pair, the key levels on the H1 scale are: 1.1131, 1.1115, 1.1102, 1.1079, 1.1064 and 1.1031. Here, we are following the descending structure of January 16.

Short-term downward movement is expected in the range of 1.1079 - 1.1064. The breakdown of the last value will lead to a pronounced movement. Here, the potential target is 1.1031. We expect a pullback to the top from this level. Short-term upward movement is possibly in the range 1.1102 - 1.1159. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1131. This level is a key support for the downward structure.

The main trend is the descending structure of January 16

Trading recommendations:

Buy: 1.1102 Take profit: 1.1113

Buy: 1.1116 Take profit: 1.1130

Sell: 1.1078 Take profit: 1.1065

Sell: 1.1063 Take profit: 1.1034

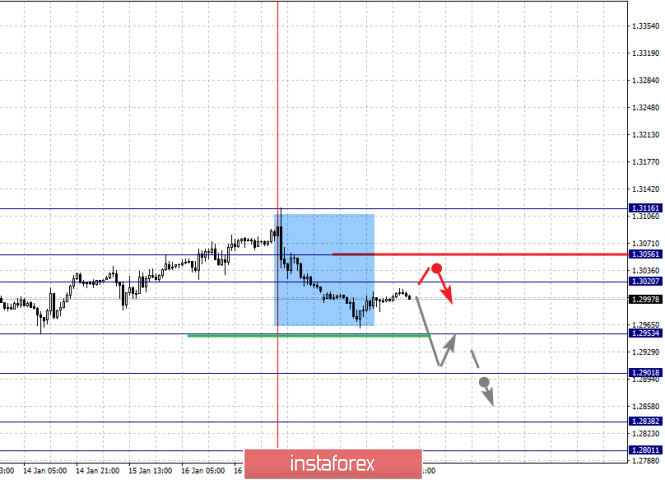

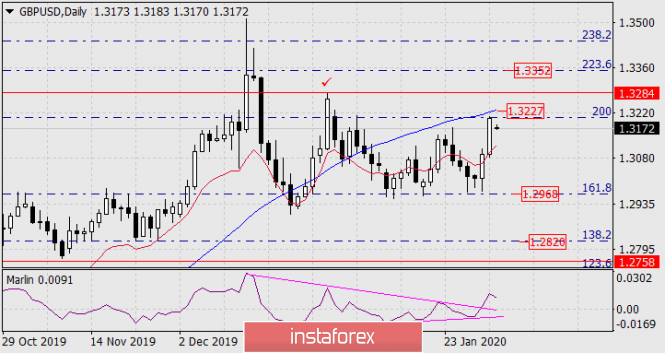

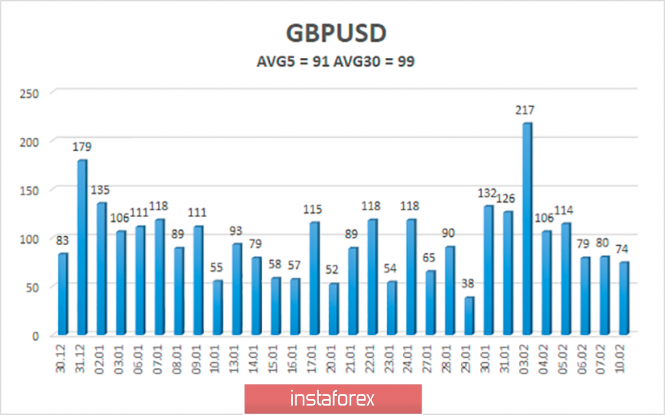

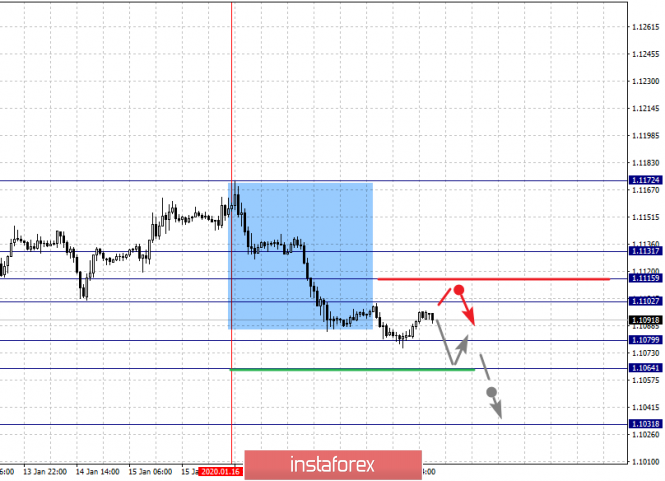

For the pound / dollar pair, the key levels on the H1 scale are: 1.3116, 1.3056, 1.3020, 1.2953, 1.2901, 1.2838 and 1.2801. Here, we are following the formation of the descending structure of January 17. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.2953. In this case, the target is 1.2901. Price consolidation is near this level. The breakdown of the level of 1.2900 will lead to the development of pronounced movement. Here, the goal is 1.2838. For the potential value for the bottom, we consider the level of 1.2801. Upon reaching which, we expect a pullback to the top.

Short-term upward movement is possibly in the range of 1.3020 - 1.3056. The breakdown of the latter value will lead to the formation of initial conditions for the upward cycle. Here, the potential target is 1.3116.

The main trend is the descending structure of January 17

Trading recommendations:

Buy: 1.3020 Take profit: 1.3053

Buy: 1.3057 Take profit: 1.3114

Sell: 1.2952 Take profit: 1.2904

Sell: 1.2898 Take profit: 1.2838

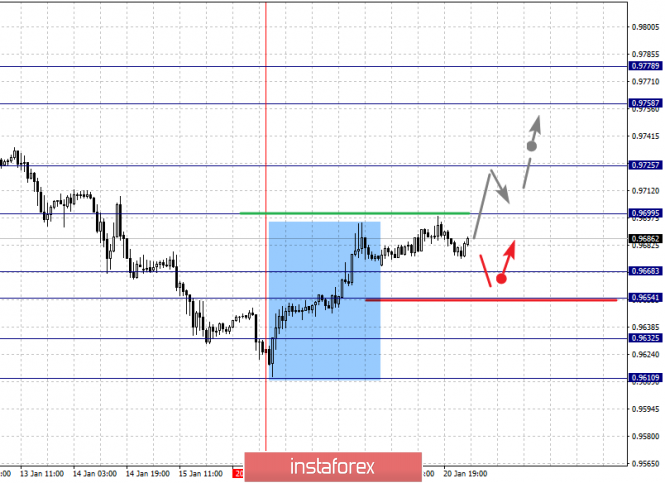

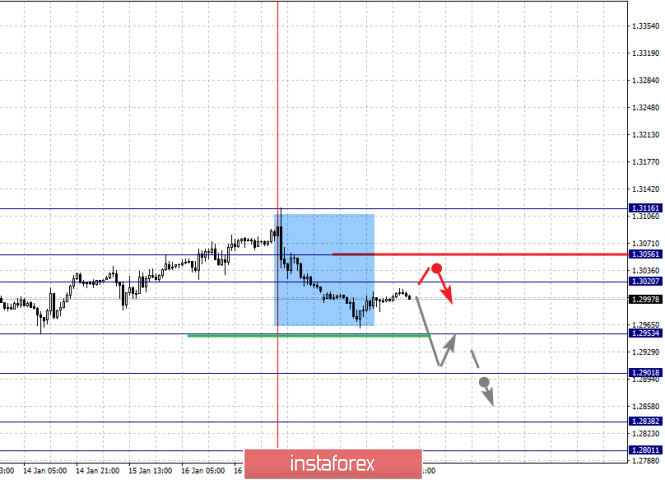

For the dollar / franc pair, the key levels on the H1 scale are: 0.9778, 0.9758, 0.9725, 0.9699, 0.9668, 0.9654, 0.9632 and 0.9610. Here, the price forms the expressed initial conditions for the top of January 16. The continuation of the movement to the top is expected after the breakdown of the level of 0.9700. In this case, the target is 0.9725. Price consolidation is near this level. The breakdown of the level of 0.9725 will lead to pronounced movement. Here, the target is 0.9758. For the potential value for the top, we consider the level of 0.9778. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 0.9668 - 0.9654. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.9632. This level is a key support for the top.

The main trend is the formation of initial conditions for the top of January 16

Trading recommendations:

Buy : 0.9700 Take profit: 0.9725

Buy : 0.9727 Take profit: 0.9756

Sell: 0.9667 Take profit: 0.9655

Sell: 0.9652 Take profit: 0.9635

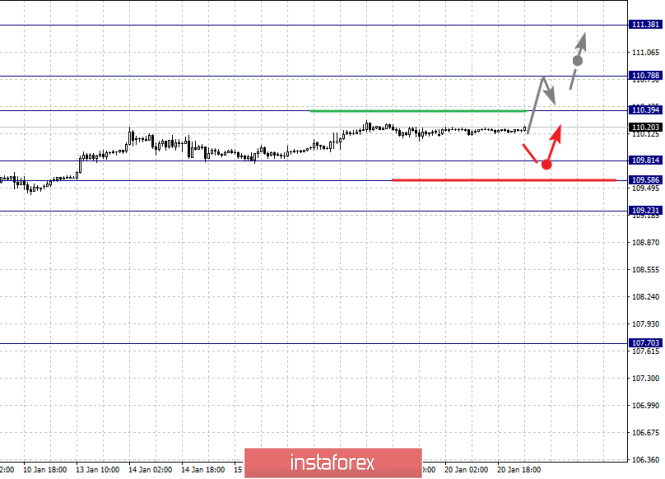

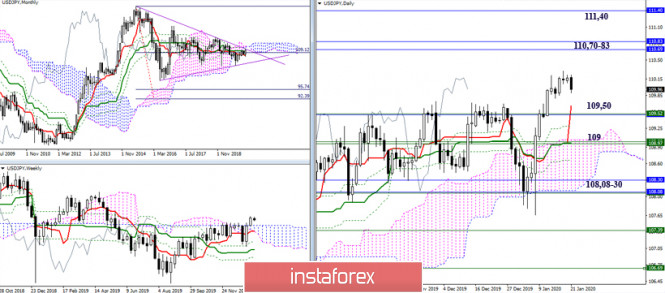

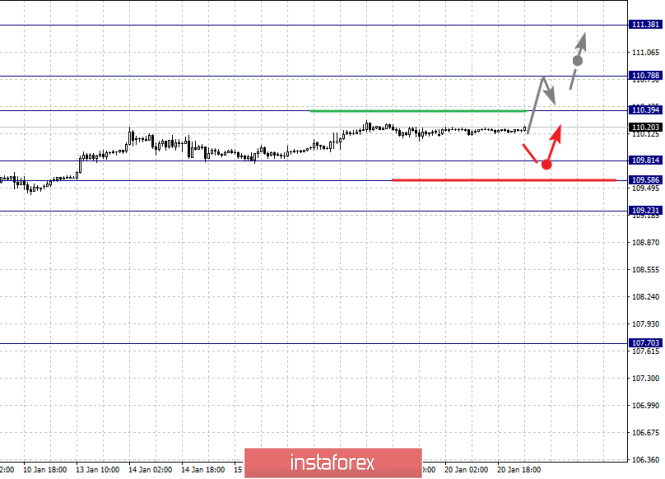

For the dollar / yen pair, the key levels on the scale are : 111.38, 110.78, 110.39, 109.81, 109.58 and 109.23. Here, we are following the development of the upward cycle of January 8. At the moment, we expect to reach the level of 110.39. The breakdown of which will allow us to count on movement to the level of 110.78. Price consolidation is near this value. The breakdown of the level of 110.80 should be accompanied by a pronounced upward movement. Here, the potential target is 111.38. Short-term downward movement is possibly in the range 109.81 - 109.58. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 109.23. This level is a key support for the top. The main trend: the upward cycle of January 8.

Trading recommendations:

Buy: 110.40 Take profit: 110.76

Buy : 110.80 Take profit: 111.35

Sell: 109.80 Take profit: 109.58

Sell: 109.55 Take profit: 109.25

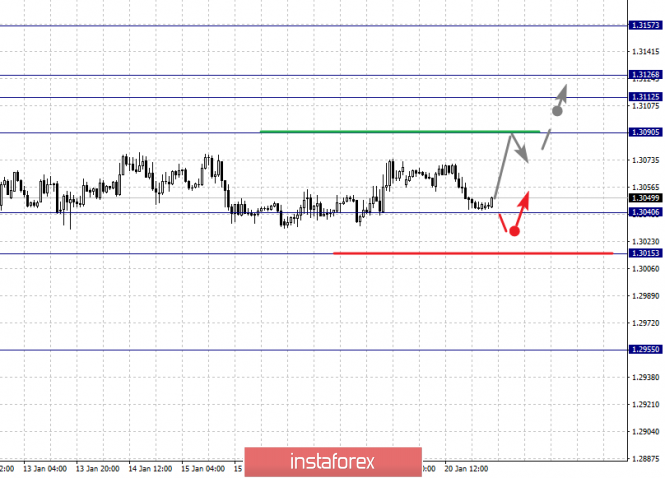

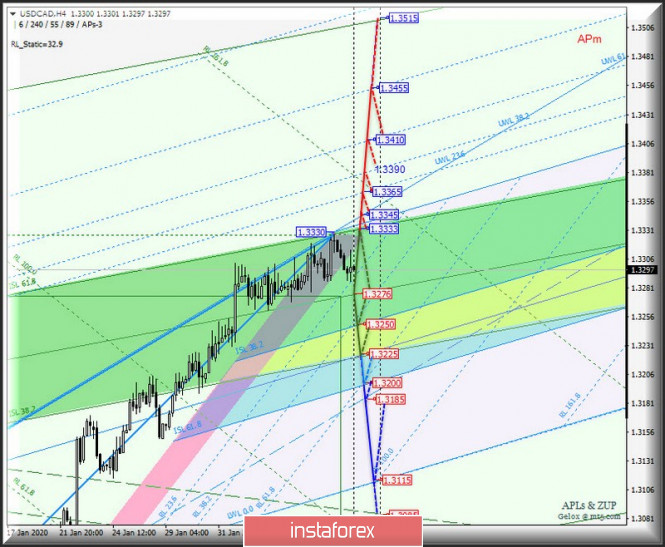

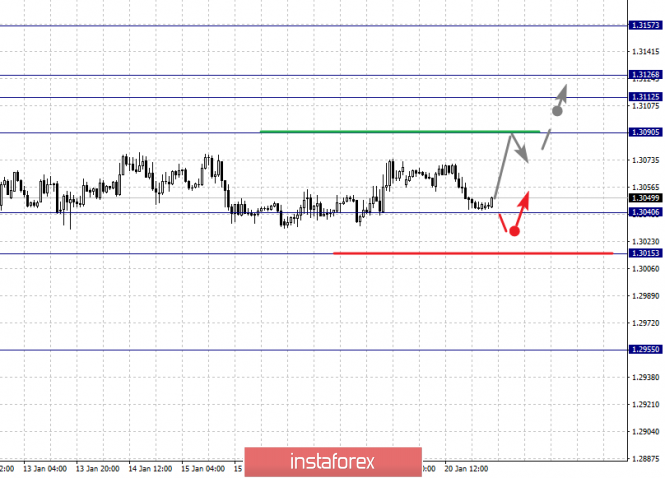

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3157, 1.3126, 1.3112, 1.3090, 1.3062, 1.3040 and 1.3015. Here, we are following the development of the upward cycle of January 7. The continuation of the movement to the top is except after the breakdown of the level of 1.3090. In this case, the target is 1.3112. Price consolidation is in the range of 1.3112 - 1.3126. For the potential value for the top, we consider the level of 1.3157. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement, as well as consolidation are possible in the range of 1.3040 - 1.3015. The breakdown of the latter value will lead to the formation of initial conditions for the downward cycle. In this case, the potential target is 1.2988.

The main trend is the upward cycle of January 7, the correction stage

Trading recommendations:

Buy: 1.3090 Take profit: 1.3112

Buy : 1.3126 Take profit: 1.3155

Sell: 1.3038 Take profit: 1.3017

Sell: 1.3013 Take profit: 1.2990

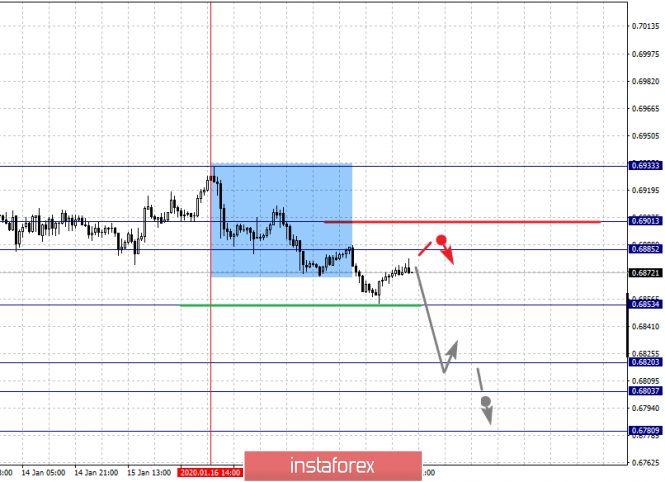

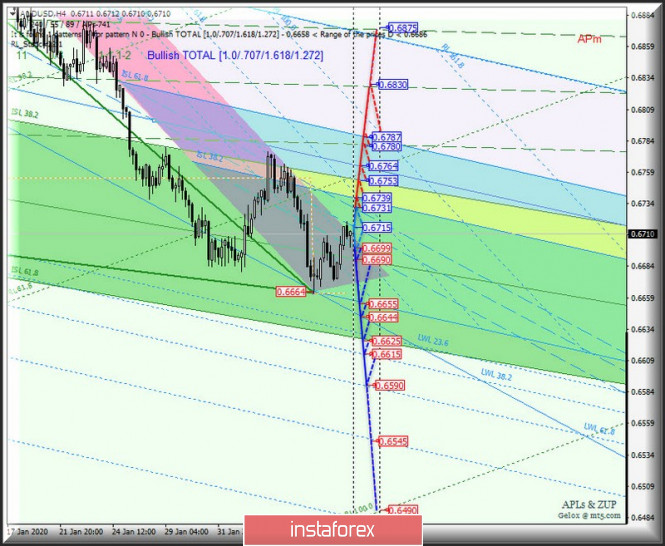

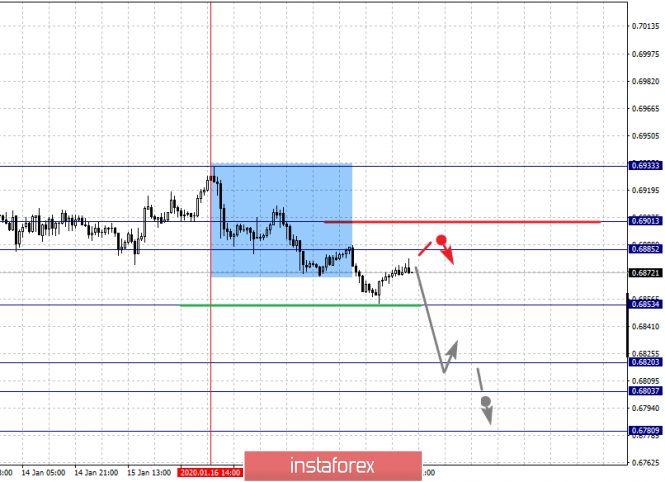

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6933, 0.6901, 0.6885, 0.6853, 0.6820, 0.6803 and 0.6780. Here, we are following the development of the descending structure of January 16. The continuation of movement to the bottom is expected after the breakdown of the level of 0.6853. In this case, the target is 0.6820. Price consolidation is in the range of 0.6820 - 0.6803. For the potential value for the bottom, we consider the level of 0.6780. Upon reaching this level, we expect a pullback to the top.

Short-term upward movement is expected in the range of 0.6885 - 0.6901. The breakdown of the latter value will lead to the formation of initial conditions for the top. In this case, the potential target is 0.6933. The main trend is the descending structure of January 16

Trading recommendations:

Buy: 0.6885 Take profit: 0.6900

Buy: 0.6904 Take profit: 0.6930

Sell : 0.6851 Take profit : 0.6823

Sell: 0.6820 Take profit: 0.6804

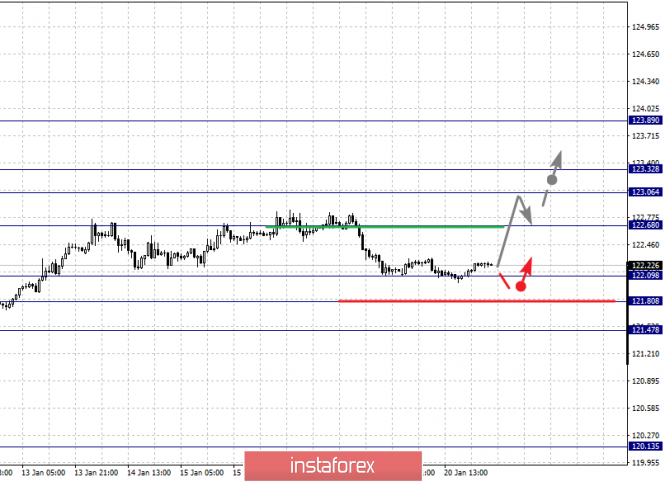

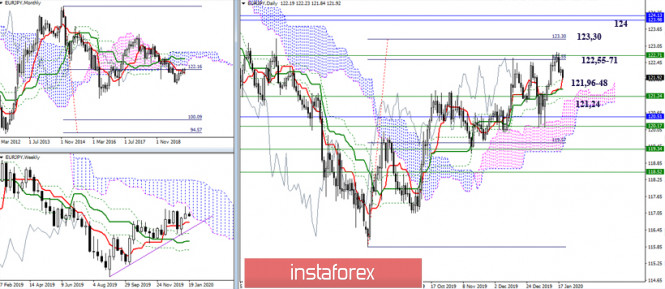

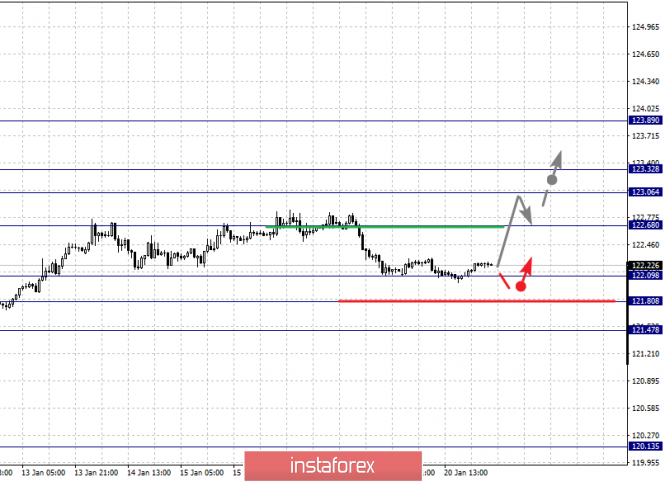

For the euro / yen pair, the key levels on the H1 scale are: 123.89, 123.32, 123.06, 122.68, 122.09, 121.80 and 121.47. Here, we are following the development of the upward cycle of January 8. The continuation of the movement to the top is expected after the breakdown of the level of 122.68. In this case, the first target is 123.06. Short-term upward movement, as well as consolidation is in the range of 123.06 - 123.32

.The breakdown of the level of 123.35 will lead to a movement to a potential target - 123.89, from this level, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 122.09 - 121.80. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 121.47. This level is a key support for the upward structure.

The main trend is the upward cycle of January 8, the correction stage

Trading recommendations:

Buy: 122.70 Take profit: 123.05

Buy: 123.06 Take profit: 123.30

Sell: 122.07 Take profit: 121.84

Sell: 121.80 Take profit: 121.50

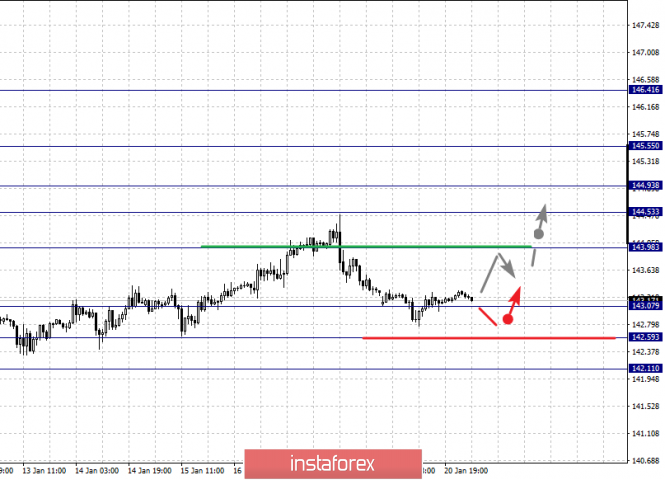

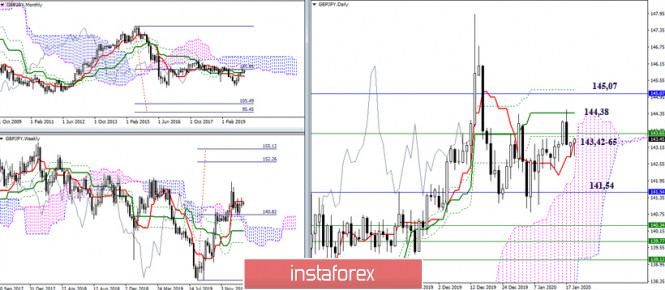

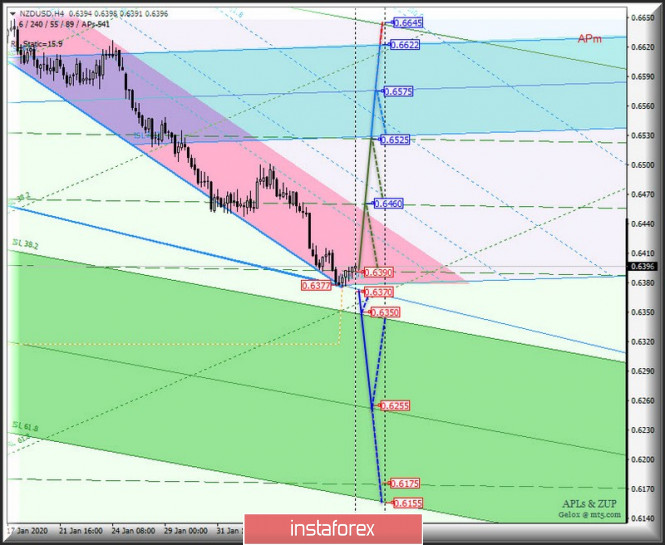

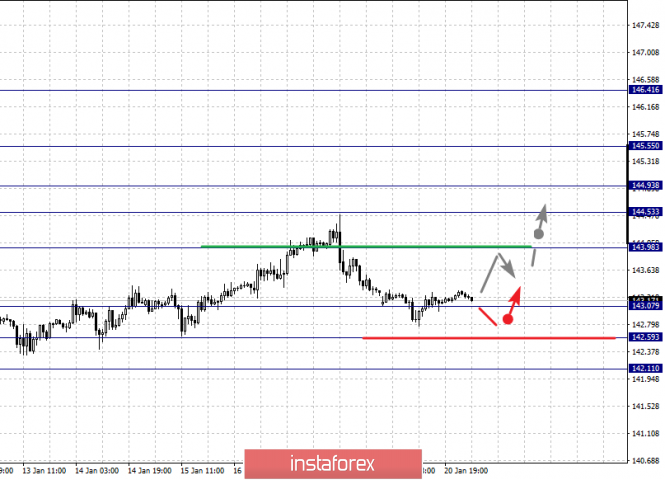

For the pound / yen pair, the key levels on the H1 scale are : 146.41, 145.55, 144.93, 144.53, 143.98, 143.07, 142.59 and 142.11. Here, we are following the development of the ascending structure of January 3. At the moment, the price is in correction. The resumption of movement to the top is expected after the breakdown of the level of 144.00. In this case, the first goal is 144.53. Short-term upward movement is expected in the range of 144.53 - 144.93. The breakdown of the latter value will lead to a movement to the level of 145.55, and near which, we expect consolidation. For the potential value for the top, we consider the level of 146.41, from which we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 143.07 - 142.59. The breakdown of the latter value will lead to the formation of initial conditions for the downward cycle. In this case, the potential target is 142.11.

The main trend is the upward structure of January 3, the correction stage

Trading recommendations:

Buy: 144.00 Take profit: 144.51

Buy: 144.53 Take profit: 144.91

Sell: 143.05 Take profit: 142.65

Sell: 142.54 Take profit: 142.11

Analysis are provided byInstaForex.

Best regards, PR Manager / Learn more about InstaForex Company at http://instaforex.com