I believe Geektrader, if he want to post more, he will and if he doesn't want to, even if the last post was addressed to him, he won't even bother to reply if he doesn't want to. I don't think anyone could deter or dictate his posting. He is a very experience trader and I noticed he comes and go anytime he wishes and he has much to give and share if he wants (to build up this community, then we are very honored to have him but if he choose to come here only if it benefit him, then it's also his prerogative, as much as yours ).

You are one of the users who contribution extensively and thus you won my deep respect. I know you have good forum ethics such as trying not to hijack a topic. But not everyone knows of this "unspoken" rules.

Yes, I've been here a long time to bear with many kinds of users. Though I do wish some are more tolerance of others and we have the space to chill and chat too and joke around (without personal attack). And yes, I do at times, feel there isn't much discussion here and hence, the last thing, I want, is to see new comers feel unwelcome or worried whether they posted wrongly in the wrong chat, etc cos who knows, one day such new comers are going to be a strong contributor too.

I also understand that people are capable of tracking the thread and won't be affected by the "last" post. People have the tendency to pick what interest them, they are not dictated by what's the last post.

I hold you and Geektrader in high regard and we have much to learn from you both and if you think this forum isn't worthy of your time, then I've nothing to say. I wanted to quit at times too but I still stayed on because I think we can still make this a better place for learning and supporting one another.

Now Geektrader, back to you...(I know you are a busy person and if you want to reply, then kindly enlighten us with your extensive experience, surely you aren't a person who is so easily bruised in your ego)

1. When you use 32 years historical data, how much do you select for OOS% or do you use the entire 32 years data as your IS?

2. I saw the graph you posted, it has very high monthly returns (wow, impressive) are these just backtesting results or do you experience the same outcome also in your live results, i.e. what you see (in the backtesting results) is also reflected in your live trading? I used to think it is "redundant" to use such long historical data but your stats are impressive enough to make me have second thoughts.

3.

geektrader wrote: So basically my systems, before they go live, have passed 192 combined years of backtests and 160 years of these completely OOS with at least a 4 return / dd ratio.

this statement gave tremendous credit and no wonder your systems are good.

So the question is, what's the % of these strategies failed in live trading? i.e. these strategies that passed your extensive testing before live, how many % of these continue to do well in live trading? 100%?

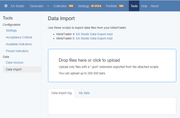

3. When you use EA Studio, do you use the 32 years data for Generating only or you also use the Reactor (with optimization? Walk forward? how many segment?) in another words, what would you recommend as a successful workflow/settings?

In the nutshell, is there any particular workflow that you think will offer higher successful rate when using EA Studio? Bear with me, I only switched over to use EA Studio recently, about 2mth ago. And I also noticed that EA Studio yield rather good results (what puzzled me most is to examine the rules and find the them somehow odd, something that I won't be using for manual trading, against conventional rules, ie. buy when indicator is falling instead of rising).