Table of Contents

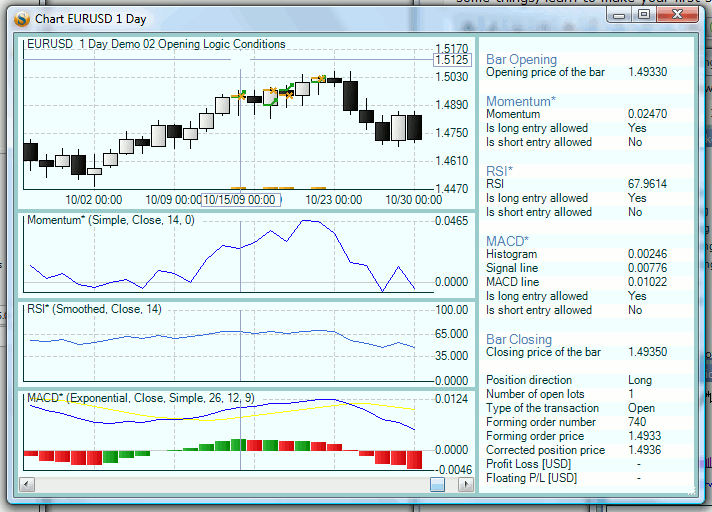

Demo 02 Opening Logic Conditions

Author's Description

This strategy is for demonstration only and real-time trading is not advised.

This strategy uses several “Opening Logic Condition” slots. Each of the slots contains one logical condition for entering the market and the possible outcome for each is either being satisfied or not (calculated for both long and short entry although we enter only long entry rules – the program calculates opposite short entry rules automatically).

Forex Strategy Trader will open a position when the market reaches the indicator's price used in the “Opening Point of the Position” slot and all the “Opening Logic Condition” are true.

In this sample strategy the price at which we enter the market is the first price of the bar or the “Bar Opening” price (as set in the “Opening Point of the Position” slot of the strategy screen). However, before we actually buy or sell all the other entry rules (in the following green slots) must be satisfied, both for long and short positions.

So to break it down - at the beginning of each bar the software checks for the following:

- The Momentum indicator is raising; AND

- The RSI indicator value is more than 65; AND

- The MACD line is above zero. And if all of the above is in order we would enter the market long.

When opening short position the software checks for the same conditions but using the opposite logic:

- The Momentum indicator is falling; AND

- The RSI indicator value is less than 35; AND

- The MACD line is below zero.

Basically all the “Opening Logic Condition” slots are our entry filters that set the logic for entering the market long or short. The thing to note is that ALL of the entry conditions must be satisfied for the FST to open a position.

Generated Description

Opening (Entry Signal)

Open a new long position at the beginning of the bar when all the following logic conditions are satisfied:

- the Momentum* (Simple, Close, 14, 0) rises; and

- the RSI* (Smoothed, Close, 14) is higher than the Level 65; and

- MACD* (Exponential, Close, Simple, 26, 12, 9); the MACD line is higher than the zero line.

Open a new short position at the beginning of the bar when all the following logic conditions are satisfied:

- the Momentum* (Simple, Close, 14, 0) falls; and

- the RSI* (Smoothed, Close, 14) is lower than the Level 35; and

- MACD* (Exponential, Close, Simple, 26, 12, 9); the MACD line is lower than the zero line.

Closing (Exit Signal)

Close an existing long position at the end of the bar.

Close an existing short position at the end of the bar.

Handling of Additional Entry Signals

Entry signal in the direction of the present position:

- No averaging is allowed. Cancel any additional orders which are in the same direction.

Entry signal in the opposite direction:

- No modification of the present position is allowed. Cancel any additional orders which are in the opposite direction.

Trading Size

Always trade a constant number of lots.

- Opening of a new position - 1 lot.

Permanent Protection

The strategy doesn't use a Permanent Stop Loss.

The strategy doesn't use a Permanent Take Profit.

* Use the indicator value from the previous bar for all asterisk-marked indicators!